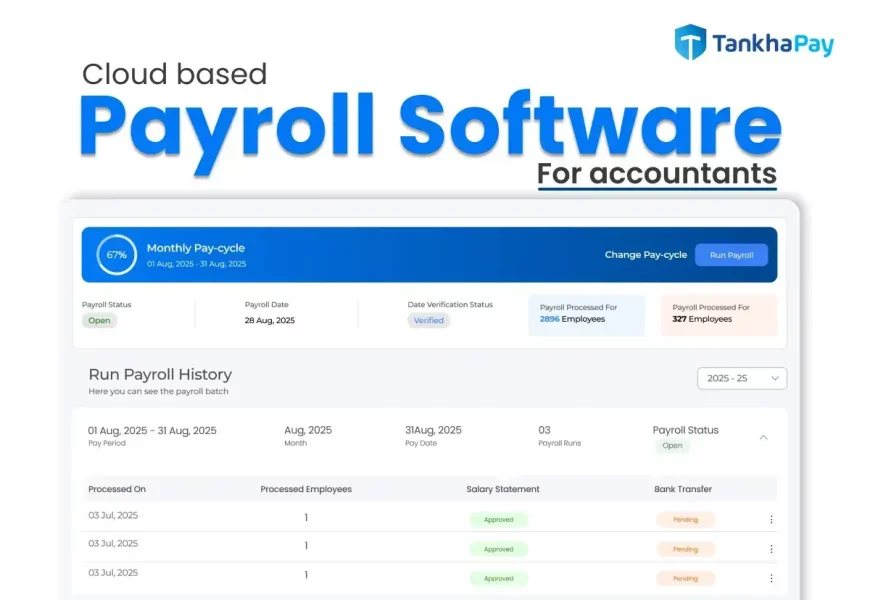

Cloud Based Payroll Software for Accountants: A Complete Guide for 2025

Introduction

Accountants today handle far more than numbers—they manage compliance, client advisory, employee payouts, tax filing, audits, and financial reporting. But traditional payroll tools and offline spreadsheets often slow them down.

This is exactly why cloud-based payroll software for accountants has become a game-changer.

With businesses shifting to digital-first systems, cloud payroll gives accountants the power to manage multiple clients, automate complex calculations, reduce compliance risks, and work from anywhere—without installing anything on their computer.

In this guide, you’ll learn:

✔ What cloud payroll is

✔ Why accountants need it

✔ Key features

✔ Benefits for multi-client workflows

✔ How it improves accuracy & compliance

✔ How to choose the best cloud payroll software

Let’s get into it.

What is Cloud-Based Payroll Software?

Cloud payroll is an online platform that automates payroll activities like salary calculations, attendance sync, deductions, reimbursements, TDS, EPF/ESI filings, payslips, and compliance reporting.

Unlike traditional payroll software, everything happens on a secure server—no installation, no manual backup, and no device limitation.

How Cloud Payroll Works

- Accountants log in via browser or mobile.

- Client data is uploaded once.

- Attendance, leaves & shifts auto-sync.

- Salary calculations happen in seconds.

- Compliance reports are generated automatically.

- Payslips, challans, and returns can be downloaded instantly.

This makes the payroll process seamless, scalable, and error-free.

Why Accountants Need Cloud Payroll in 2025

The accounting industry is shifting from manual work to automation. Clients expect speed, accuracy, and compliance readiness.

Cloud payroll helps accountants:

- Serve more clients in less time

- Avoid compliance penalties

- Improve efficiency

- Deliver instant reporting

- Reduce human error

- Keep data secure and accessible

It’s no longer a luxury—it’s becoming a necessity.

Top Features of Cloud-Based Payroll Software for Accountants

1. Multi-Client Payroll Dashboard

Accountants often manage payroll for 10, 50, or even 100+ companies.

A cloud payroll system offers:

- A master dashboard

- Quick switching between clients

- Separate data for each organisation

- Role-based access

- Bulk import & export

This makes multi-client handling 10x easier.

2. Automated Payroll Calculations

The software automatically calculates:

- Basic + allowances

- PF, ESI, TDS

- Overtime

- Deductions

- LOP

- Reimbursements

- Incentives

- Bonus & final settlements

This eliminates spreadsheet fatigue, manual errors, and reconciliation issues.

3. Compliance Management

Compliance is the biggest headache for accountants.

A cloud payroll system simplifies:

- EPF, ESI, LWF calculations

- Form 24Q TDS filing

- PT calculations

- Monthly/quarterly challans

- Statutory reports

- Labour law changes updated automatically

No need to track new government rules manually—the system stays updated.

4. Attendance & Leave Integration

Modern cloud payroll integrates with:

- Biometric systems

- Mobile attendance

- GPS attendance

- Leave applications

- Shift schedules

Real-time data means payroll stays accurate automatically.

5. Auto-Generated Reports

Accountants can generate:

- Payroll summaries

- Tax reports

- Salary sheets

- Compliance reports

- Client-wise billing reports

- Audit-ready statements

All in a single click.

6. Secure Cloud Storage

Data security is critical for accountants.

Cloud payroll ensures:

- End-to-end encryption

- Regular automated backups

- No risk of system crash

- Zero data loss

This gives accountants peace of mind.

7. Digital Employee Self-Service

Employees of client companies can:

- Download payslips

- Apply for leave

- Mark attendance

- Check tax calculations

- Update bank/KYC

This reduces dependency on accountants for small tasks.

Benefits of Cloud Based Payroll Software for Accountants

✔ Saves Time

Automated calculations cut the time spent per client from hours to minutes.

✔ Zero Installation

Everything runs on the cloud—no setup, no IT support, no updates.

✔ Work From Anywhere

Home, office, travel—log in from any device.

✔ Reduces Human Errors

AI-driven calculations provide 100% accuracy.

✔ Avoids Compliance Penalties

Automatic updates ensure you always follow the latest rules.

✔ Scales Your Practice

Handle 5x more clients without additional manpower.

✔ Increased Client Satisfaction

Faster reports and accurate payroll mean happier clients.

Why Cloud Payroll Is Better Than Traditional Payroll Tools

| Feature | Traditional Software | Cloud Payroll |

| Access | Single device | Any device |

| Backup | Manual | Auto-backup |

| Updates | Manual patches | Auto-updated |

| Multi-client support | Limited | Advanced dashboard |

| Scalability | Difficult | Highly scalable |

| Data security | Higher risk | Encrypted & secure |

Cloud payroll wins in every category.

Common Challenges Accountants Face Without Cloud Payroll

- Errors due to manual entry

- Compliance deadlines missed

- Too much time spent on repetitive tasks

- Wrong salary calculations

- Handling multiple clients becomes chaotic

- High risk of data loss

- No transparency for employees

- Frequent follow-ups from clients

Cloud payroll solves all these pain points instantly.

How to Choose the Best Cloud Based Payroll Software for Accountants

Before selecting software, check for:

1. Multi-client support

Must handle unlimited clients with separate data.

2. Compliance automation

EPF, ESI, TDS, PT, LWF, Bonus, Gratuity.

3. Attendance integration

Biometric, GPS, mobile punch-in.

4. Easy UI and onboarding

Accountants should learn it in less than a day.

5. Affordable pricing

Per-company or per-employee pricing works best.

6. Scalability

Should handle 1 to 1000+ employees smoothly.

7. Security standards

ISO certified, encrypted servers, auto-backups.

8. ESS portal (Employee Self-Service)

Reduces dependency and improves workflow.

9. Support & training

24/7 chat + email support is beneficial.

Future of Cloud Payroll for Accountants

By 2027, more than 70% accounting firms in India are expected to adopt cloud-based HR & payroll tools.

Key upcoming trends:

- AI-based compliance checks

- Automated tax advisory

- Predictive payroll analytics

- API integrations

- Full HRMS + payroll ecosystem

Accountants who move early will stay ahead of competition.

Conclusion

Cloud based payroll software for accountants is not just a tool—it’s a productivity engine. It saves time, removes complexity, and gives accountants the power to handle more clients with exceptional accuracy and speed.

Whether you’re a freelance accountant, a small CA firm, or a growing payroll service provider, cloud payroll simplifies your workload and improves client satisfaction dramatically.